Financial calculators are a great way to build stronger relationships with current and future account holders. Interactive content gives you feedback on what site visitors are looking for and presents the opportunity to provide solutions to fit their individual needs. But which calculators should you choose?

Calculators cover a variety of financial topics from Auto Loans to Zero Based Budgeting and choosing a handful to feature on your site can be overwhelming. Thankfully, most financial queries can be summed up with four questions: How much do I make?, How much am I saving?, What are my expenses?, and How can I make my money grow? Choosing calculators that answer these questions will allow visitors to engage with your content and build trust through a positive user experience.

How much do I make?

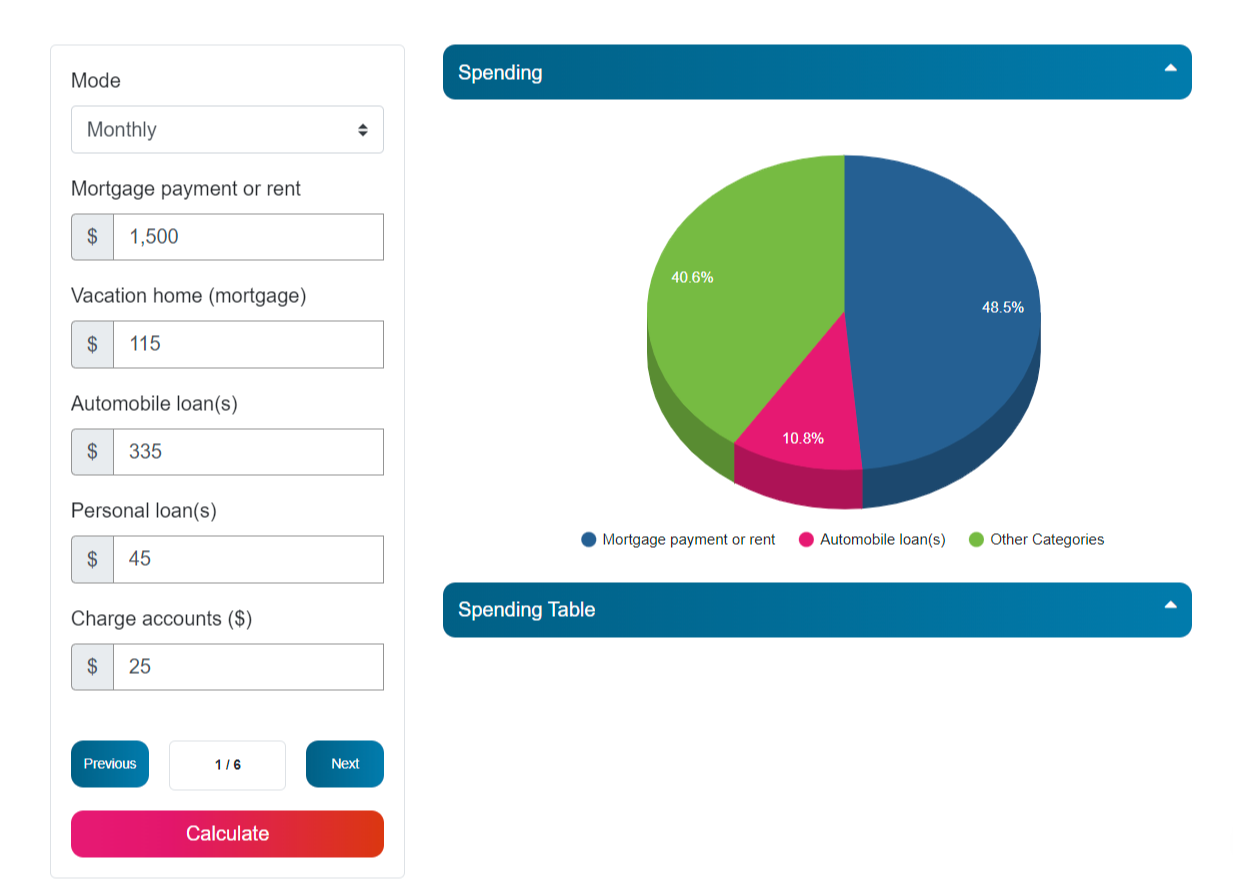

A question we all can relate to. Yet developing and sticking to a budget can be difficult. Providing a budgeting calculator gives visitors the ability to view their day-to-day finances more clearly and develop strategies to reach financial goals in the future. Based upon their situation, you can offer short or long-term loans, as well as savings products and services to help with their budgeting needs.

How much am I saving?

Savings calculators are a great tool to get visitors thinking about their financial goals. They make a perfect segue to showcasing savings products you offer such as CDs and money market accounts. You can also highlight helpful financial tools available to make their life easier like online and mobile banking, mobile deposit, and alerts.

What are my expenses?

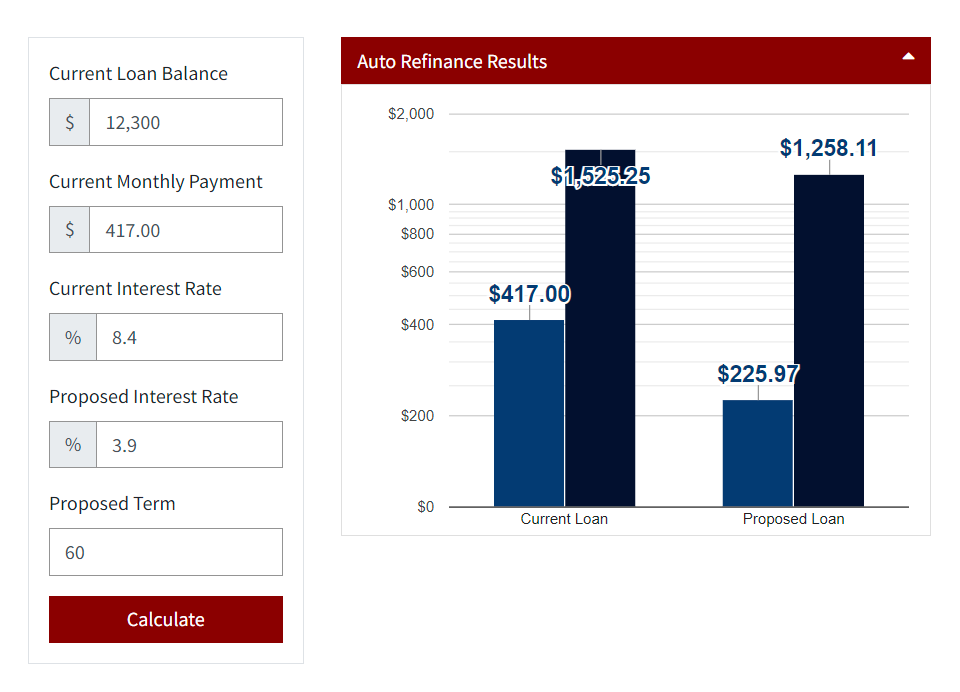

Yes, the category that immediately comes to mind when thinking of financial calculators. A home and a car are usually the two biggest purchases people make in their lifetime. A calculator that takes some of the mystery out of the myriad of expenses involved while providing more information about available loan options can make these purchases less daunting. A home or vehicle calculator can also alert prospects to services they may not be aware of such as lines of credit or GAP protection.

How can I make my money grow?

Planning for the future can be vague and fuzzy. Investment calculators make saving for retirement easier to visualize. Getting users thinking about their retirement years and how you can help them reach their financial goals with your savings products and services is the perfect opportunity to open the door to a lifelong connection with your financial institution.

Are you interested in adding financial calculators to your bank or credit union’s website? Contact LKCS and let us show you the different types we have available.

Did you like this blog post?

Get more posts just like this delivered twice a month to your inbox!