DataFlex has powerful ad-hoc reporting and a large number of pre-made reports and charts and visualizations with plenty of information about members, balances, averages, and other numbers. There is another feature of DataFlex I’d like to discuss today, and that is targeted marketing campaigns.

Onboarding Campaigns

One of the keys to retaining new members is getting them to open multiple accounts and to get them used to the idea of coming to your credit union first for all of their needs. This is where onboarding campaigns are essential to your credit union. The first month that a new member joins your credit union, you can send them a welcome letter, postcard, or e-mail and inform them about the various services available to them.

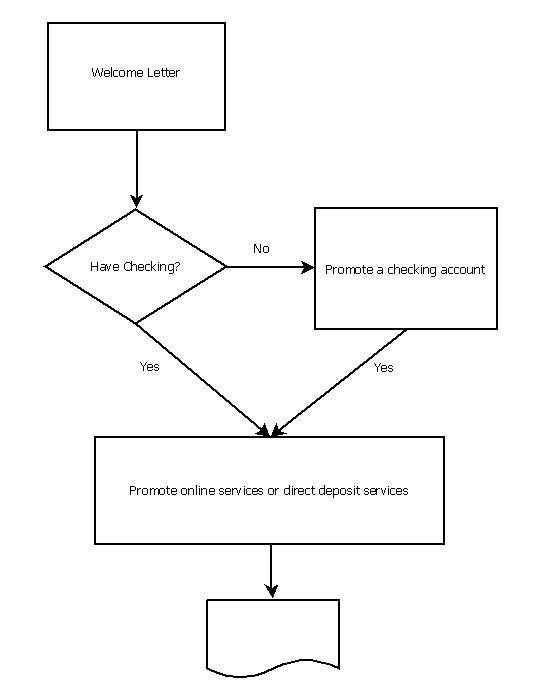

Here is where DataFlex comes in. Based on information such as age, balances, and what accounts they currently have, different welcome letters could be sent to your members. For example, if a member opened a share account but doesn’t have a checking account, they could receive a letter encouraging them to open a checking account. Alternatively, if they already have a checking account, online services or direct deposit services could be promoted. The flow chart illustrates this.

Send a follow-up communication a few weeks later and help your credit union remain fresh in the minds of new members. Using DataFlex and your credit union’s criteria, other, more profitable, accounts such as loans or credit cards could be promoted to your new members.

Your onboarding campaign can continue on in this manner for 6 months or more, flowing through an entire range of your services. This can start out with standard checking, then move on to interest-bearing checking, online services, direct deposits, CDs, safe deposit boxes, car loans, mortgages, home equity, etc. The powerful flexibility of DataFlex means that multiple branches can be added to the flowchart using different, multiple criteria. Members with higher balances but no mortgage could be sent down one path to home loans and younger members could be sent down another branch to auto loans.

New Services and Ongoing Targeted Marketing

Let’s say you have a great onboarding campaign in place. What are you doing about your long-time members that already use a number of your credit union’s products and services? If you have a new product, let’s say a new home equity product, you can use DataFlex to narrow down your membership to those that are home owners between specified ages. Then you could further narrow it down to those that have children and promote home equity to fund education expenses. Or, you could promote home equity to fund vehicle purchases for members with available equity and no auto loans or only one auto loan.

Another way to use DataFlex is to have an ongoing campaign set up for a cyclical product such as auto loans or Christmas savings accounts. Every time a member is close to paying off an auto loan, a postcard or e-mail could be sent to the member offering a special rate on a new loan. DataFlex can be used to narrow the list down to members with good credit scores and no late payment before generating the final mailing list. Even more importantly, DataFlex can be used to track the success of each of your onboarding and marketing campaigns, and your criteria can be tweaked.

Contact us today to find out more about DataFlex

Onboarding campaigns and targeted marketing are very useful tools for credit unions to retain members and get more of their business. What I covered was just an overview of what can be done with targeted marketing by using DataFlex. Contact LKCS today to learn more about DataFlex and what it can do for your credit union!

Did you like this blog post?

Get more posts just like this delivered twice a month to your inbox!