Early in 2015 I discussed our upgraded DataFlex platform, and explained the new look as well as the new features found in the app. Today I’m excited to share more information about our training videos and other new enhancements we’ve made to DataFlex!

Training Videos

When a client signs up for DataFlex, our sales team does a lot of hands-on training with them so that they can maximize their DataFlex experience. However, sometimes a refresher is needed or other employees were not available for the hands-on training. To answer this need, we’ve created online training videos that stream straight to the browser.

Accessible directly from within DataFlex, these videos are concise 1-2 minute clips that explain how to do numerous common tasks and are easy to refer to while interacting with DataFlex. Our training videos are neatly organized into categories to help our clients quickly find what they need.

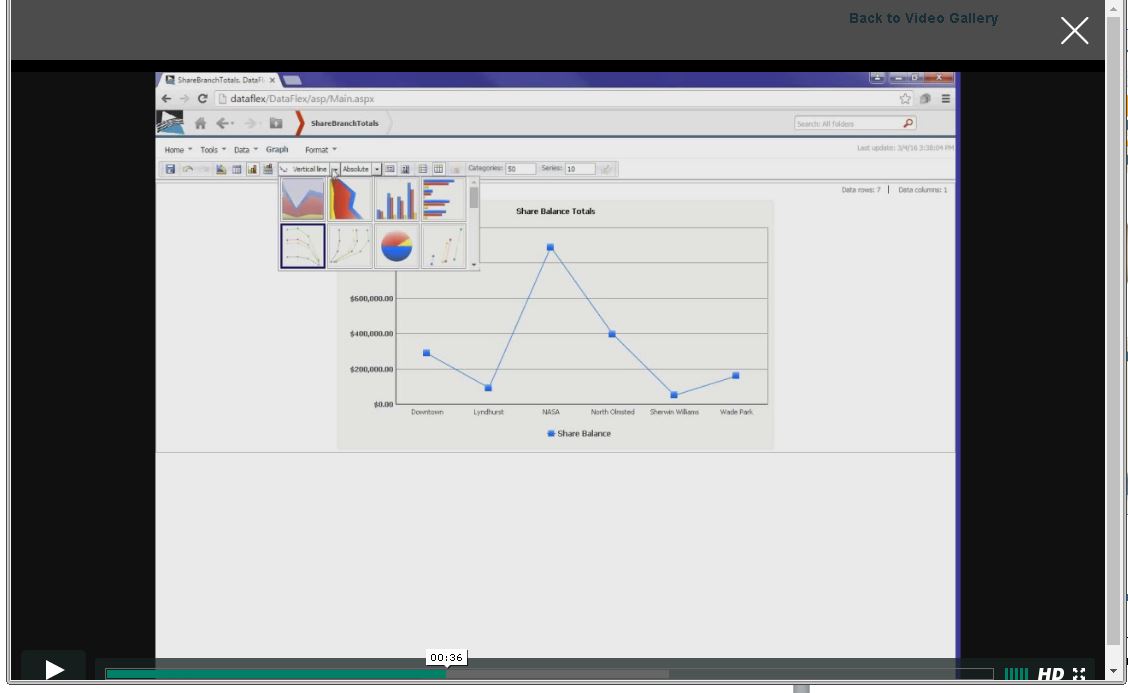

Once a video has been selected, it can be played in full-screen mode. There are voice-over instructions that walk the user through the steps being carried out on-screen.

Tracking Member Products and Services

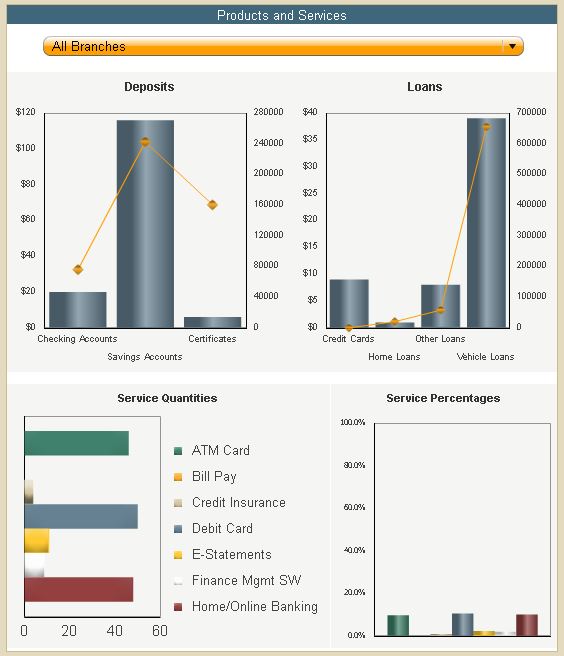

While the core of DataFlex was built around savings/shares and loan products, there are many other products and services that need to be analyzed as well. The more of these services that are used, the more the credit union becomes the primary financial institution for that member. We have expanded our capabilities to record and track services such as:

- ATM Cards

- Bill Pay

- Credit Insurance

- Debit Cards

- Direct Deposit

- E-Statements

- Financial Advice

- Investment Services

- Mobile Banking

- Money Management Software

- Online Banking

- Remote Deposit Capture

Information about these services, if provided to us, can be reported and charted just like any Share or Loan products. We have built dashboards for tracking growth in service usage and percentages of the membership using each service.

SEG Groups and Marketing Groups

SEG Groups, or Select Employee Groups, are a feature that more and more of our clients have asked us to track. Our clients also have asked to track other groups of members. Some of these groups include: members targeted in various marketing campaigns, members acquired as a result of mergers with other credit unions, or even specific member numbers provided to us from a list built externally. We have added this capability to DataFlex as well, and just like any other group that DataFlex can filter upon, these members can be included or excluded as desired from reports and dashboards.

New Member and Lost Member Dashboards

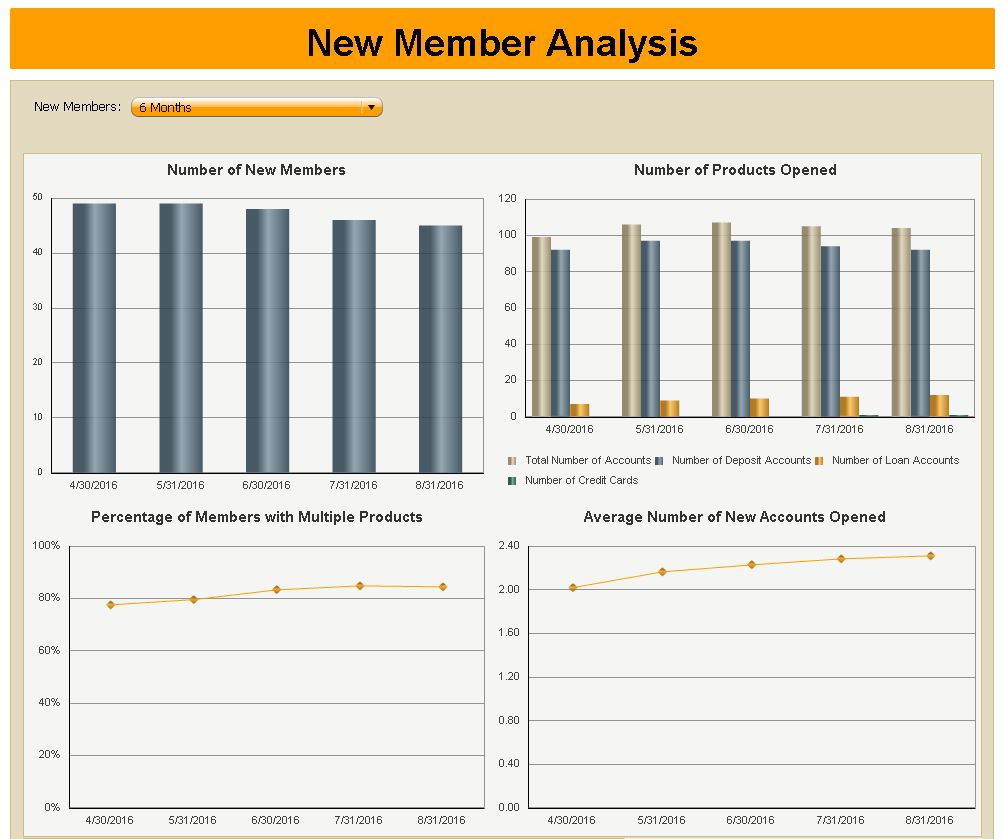

Analyzing new members and their product and service penetration is important for retention. Thus, lately we have focused on building dashboards that analyze new members that have recently joined, and their products and services.

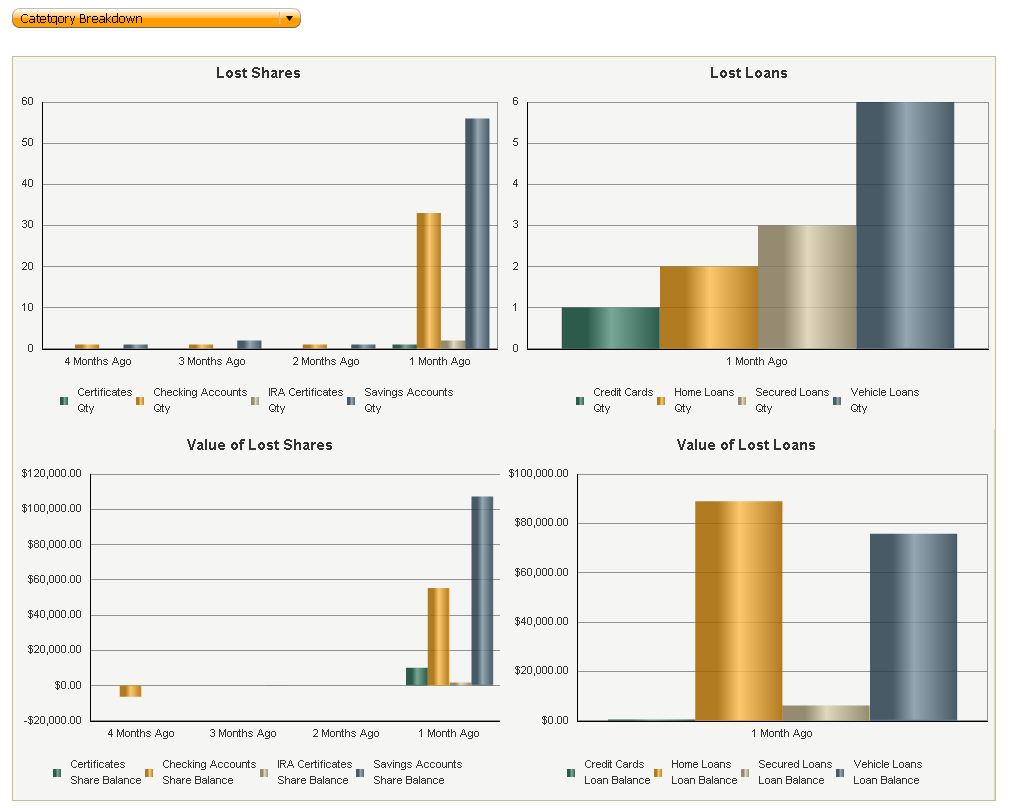

In addition, we have built other dashboards to analyze the products and value of accounts closed by former members. Looking at the product types and balances may lead to some insights that can aid in retention.

Talk to us today to take full advantage of DataFlex

Our training videos help our clients learn faster and build the reports they need more so they can analyze their data more thoroughly. The additions I described expand the capabilities of DataFlex, making it more powerful and enabling more connections and insights to be made. Contact LKCS today to learn more about DataFlex and what it can do for you.

Did you like this blog post?

Get more posts just like this delivered twice a month to your inbox!