I do a great deal of work on our custom financial calculators. There are nearly 70 unique calculators we currently offer for auto loans, mortgages, savings, college expenses, investments, loan payoff, debts, including various retirement and refinancing options. However, there is one calculator we’ve implemented that I find very interesting.

Our Investment Questionnaire calculator is unique in that the user inputs are not simple numerical options such as loan amount or interest rate but is setup as a series of 10 questions that help provide assistance and guidance for someone interested in investing. Simply, it provides ideas on portfolio allocation based on your propensity for risk.

Our Investment Questionnaire Calculator In Action

Below are a few examples of the questions being asked to the end-user:

The Results

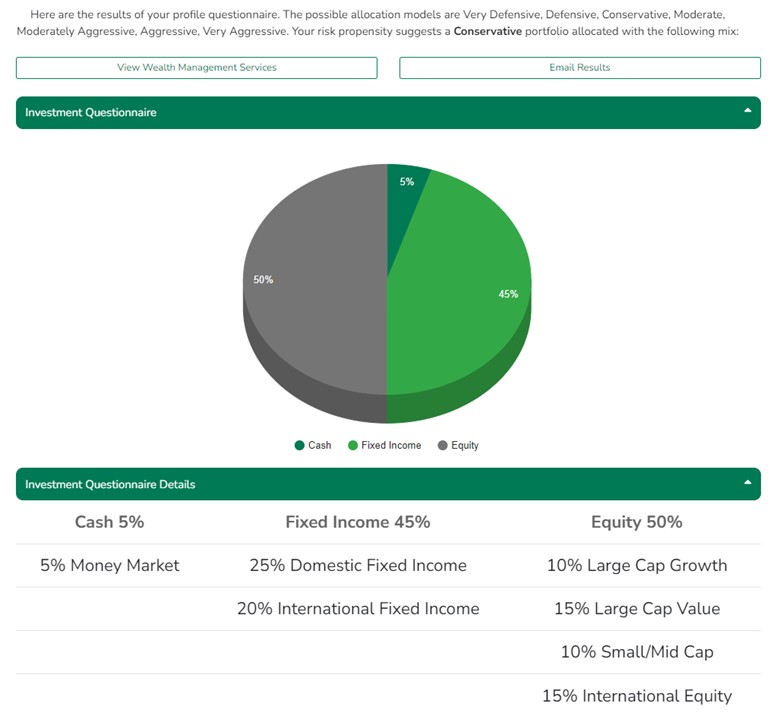

After all questions are completed, you are presented with results such as the following:

The results are complete with a pie chart and allocation recommendations in cash, fixed income, and equity. There is a detailed breakdown of domestic versus international fixed income, as well as percentage recommendations on equity capitalization for each level. Based on the answers to the questions, users will receive a simplified recommendation on which allocation model they should follow. In the case above, the calculator recommended a conservative portfolio.

It’s very interesting to see such a calculator in action, versus typical calculators that may require you to have information on unknowns such as home or auto loan interest rates. Answering simple questions based on your own propensity for risk helps navigate through such unknowns.

If you’d like to try the Investment Questionnaire calculator for yourself, please do so here.

Did you like this blog post?

Get more posts just like this delivered twice a month to your inbox!