Google My Business has been around since 2014, but only in the last year or two has it really picked up speed. It is an essential digital marketing tool for every financial institution or business if they want to connect with people searching locally.

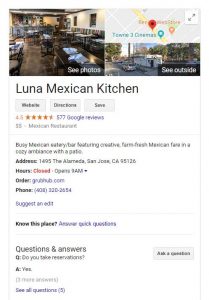

If you think you’re not familiar with Google My Business (GMB), I’m willing to bet you are. You’ve probably searched for a local restaurant or shop in your town, which should’ve brought up a listing that looks like this:

These are Google My Business Listings. They pop up on Google search results or Google maps, which are both widely used. In fact, 89% of local searchers admit to searching for a local business on their smartphone once a week or more. As much as 58% will search daily.

As a bank or credit union, this is a large amount of new and existing account holders you could be reaching. Ignoring or not even claiming your free listing spells trouble and here’s why.

1.) You could be displaying the wrong information.

Just because your listing is on Google, it doesn’t mean it is correct. Even if you have claimed it. Google can populate your listing with incorrect data collected from other sources. Users can suggest edits to your listing which aren’t true. I recently came across this problem for a client when someone labeled their credit union as open 24-hours on Sundays. If you’re not actively monitoring your listings, this data will display for all to see and can lead to complaints from customers.

2.) You’re losing phone calls and foot traffic.

A big reason why people search locally is for basic contact information. GMB allows you to display this information directly on Google Maps or Search. This makes it much more convenient for account holders to quickly get ahold of you. They can click on your phone number right from their phone’s browser and call your branch. With the right address listed, they can map themselves to their preferred branch without leaving their Google Maps app. The wrong information listed means less phone calls and lost and probably frustrated customers.

3.) You have multiple branches but the information is mixed up

Google tries to do its best to pull in the right information. Banks or credit unions with multiple locations often run into various issues, such as:

- The wrong phone number is displayed for the wrong branch.

- Sometimes not all branches make it to maps, so it looks like a city only has one branch when in fact it has three.

- ATM-only locations aren’t labelled correctly and account holders will map themselves to it when they actually needed to visit your branch to speak with someone.

Synchronize company name, address, phone, hours, and other information across scores of local listing sites to improve SEO with LKCS’ Local Listing Management Service.

4.) Bad photos are giving the wrong impression.

Photos of a business displayed on GMB can come from different sources. Primarily they should come from the listing owner. Customers can also submit their own photos, which can be a problem. Most likely, the photo will not be in the best light or angle. I’ve seen some users scribble angry messages over a picture after a bad interaction. Others can be worse. Submitting your own high-quality images of your financial institution ensures you are shown in the proper light. Additionally, photos can help customers who are following directions from Google Maps to recognize your building when they arrive.

5.) You’re nowhere to be found.

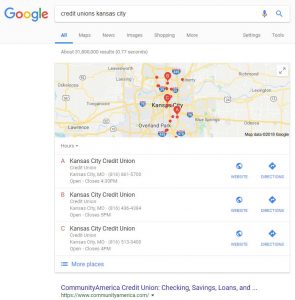

Google is putting a lot of preference on GMB. It’s used to populate results in Google Local Pack, which often displays above organic results:

It’s what displays for users who are searching directly in Google Maps as well. Claiming and optimizing your listing can help improve your organic reach on Google. This means people will be more likely to find you if they’re doing basic searches for financial services or for any local credit union or bank nearby. If you’re not there, then I can bet your competitor is.

6.) Bad reviews are killing your reputation and traffic.

Many times, I’ve seen Google My Business listings floating out there with 1- or 2-star reviews. That’s because angry customers have historically been more likely to leave a negative review to vent and share their frustration. Bad reviews can impact you in multiple ways. Obviously, it can deter new account holders from opening an account. It can also lower your rankings and search visibility. Basically, Google only wants to show consumers businesses that are reputable (4 or 5 stars) when they can. In my last post, I detailed why building reviews for your financial institution is so important and how to do it. Make sure this is part of your overall marketing strategy.

I’ve just given you six reasons why you need to get a handle of your GMB listings. Your next step is to make sure you’ve claimed your listing for each branch. Then, make sure you’re monitoring and updating them. There’s so much more you can do to really put these to work for you. Let us know if we can help you to start managing your listings correctly.

Did you like this blog post?

Get more posts just like this delivered twice a month to your inbox!